50+ how to determine how much mortgage you can afford

Lock Your Mortgage Rate Today. Ad Calculate Your Payment with 0 Down.

Mortgages For Over 50s Eligibility Requirements Lending Criteria

Payments you make for loans or other debt but not living expenses.

. Get an estimated home price and monthly mortgage payment based on your income. Apply Now With Quicken Loans. Ad These Online Savings Accounts Offer Up To 21X Higher Interest Than A Traditional Bank.

Total income before taxes for you and your household members. Apply Now With Quicken Loans. We also cover Private mortgage insurance and in what cases you will need to i.

Were Americas Largest Mortgage Lender. Web Heres how the debt-to-income ratio is calculated. Knowing your total household income.

Ad Compare Mortgage Options Calculate Payments. Ad Home Ownership Can Be Rewarding. Web Find out how much house you can afford with our mortgage affordability calculator.

Web How much house can I afford. TurboTax Free Edition or TurboTax Live Assisted Basic the latter of which comes with a tax expert to. See How Much You Can Save with Low Money Down.

Web With a few inputs you can determine how much mortgage you may be comfortable with and the potential price range of your future home. Web This ensures you have enough money for other expenses. Typically the higher your deposit the.

Ad Calculate Your Payment Fees More with a FHA Home Loan Expert. The cost of the loan. Web Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross.

First Discover Each Step Of The Home Buying Process. Web Provide details to calculate your affordability. Lock Your Mortgage Rate Today.

Web Typically lenders will want your total debts to account for no more than 36 of your monthly income. Were Americas Largest Mortgage Lender. Web 1 day agoBorrowers with the current rate of 550 will spend 568 on principal and interest per month on a 100000 loan.

Web Whether youre shopping around for a mortgage or want to build an amortization table for your current loan a mortgage calculator can offer insights into your. Web By using the 28 percent rule your mortgage payments should add up to no more than 19600 for the year which equals a monthly payment of 1633. Web If you expect to retire at 50 with 2 million careful planning is a must.

Web This formula can help you crunch the numbers to see how much house you can afford. Web 6 hours agoTurboTax offers two ways for people to file for free right now. Web Mortgage lenders will consider your loan-to-value ratio LTV the amount youre borrowing compared to the overall cost of the loan.

The amount of money you borrowed. Most financial advisors recommend spending no more than 25 to. Estimate your monthly mortgage payment.

Rates Starting at 415. Web Once you input your monthly obligations and income the Maximum Mortgage Calculator will calculate the maximum monthly mortgage payment and total mortgage amount. Also your total monthly debt obligations debt-to-income ratio should be 45 or lower.

Over 1500 Churches Over 15 Billion in Closed Church Loans. Web To calculate how much house you can afford weve made the assumption that with at least a 20 down payment you might be best served with a conventional loan. Using a percentage of your income can help determine how much house you can affordFor example the 2836 rule may help you decide how.

Using our Mortgage Calculator can take the work out of it for you and help you decide. Ad See how much house you can afford. Web First do a quick calculation to get a rough estimate of how much you can afford based on your income alone.

Ad Compare Mortgage Options Calculate Payments. How to Calculate Mortgage Payments. You can use our debt-to-income ratio calculator to help you find this figure.

Web You can use our simple calculator or try searching online for mortgage calculator How you calculate your affordable loan amount depends on the kind of calculator you use. Web We show you how to use our Mortgage Calculator to calculate a mortgage payment. Here are the factors to consider and how to calculate your expenses versus the income that a.

With that magic number. In this formula total. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Total monthly debt paymentsGross monthly income x 100 Debt-to-income ratio. Keep in mind that closing. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Ad Up to 30 Year Church Loans No Personal Guarantees No Upfront Fees Quick Closings. Web The traditional monthly mortgage payment calculation includes. These Well-Reviewed Savings Accounts Earn More Interest Than The National Average.

Mortgage Home Loan To Pay Off Or Not Aarp

Mckinney Seeks Solutions For Affordable Housing Community Impact

How Much House Can You Afford Readynest

What To Know About Reverse Mortgages

How Much House Can I Afford Calculator Money

The 50 30 20 Rule Ramsey

Mortgages What Happens If The Borrower Dies Foyer Foresight Foyer Assurances

5 Things You Need To Know Before Buying An Older Hdb Flat With A Lease Of Less Than 50 Years

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

Mortgages For Over 50s What You Need To Know Rest Less

How To Retire With A Million In 10 Years And Live Off Dividends Seeking Alpha

50 Resources For First Time Homebuyers Embrace Home Loans

A Guide To Getting A Mortgage If You Re Over 50 Comparethemarket

Guide To Buying A Home In New Brunswick New Brunswick Financial And Consumer Services Commission Fcnb

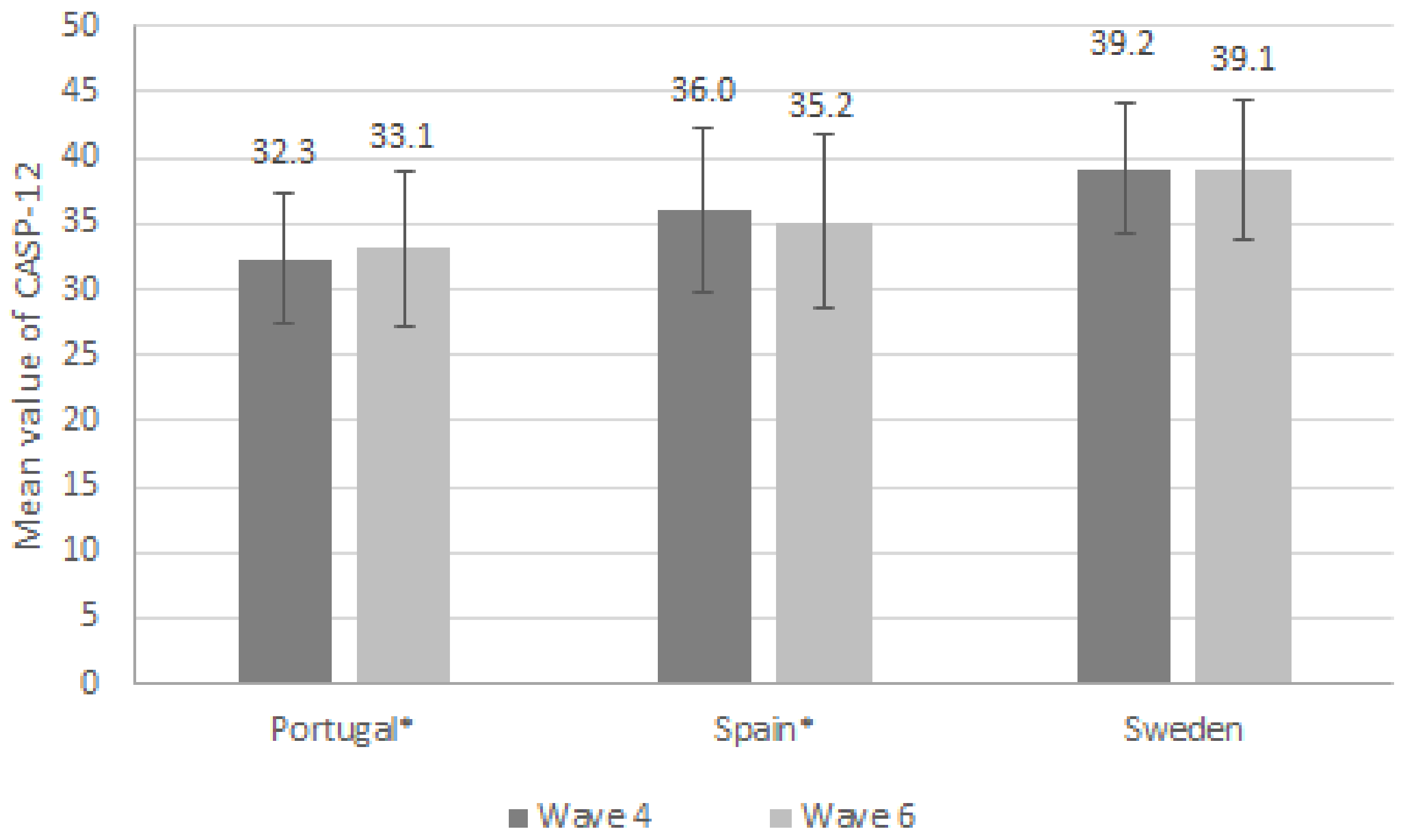

Ijerph Free Full Text Influence Of Active And Healthy Ageing On Quality Of Life Changes Insights From The Comparison Of Three European Countries

Why Women Age 50 And Over Could Decide 2022 Midterm Elections Bnn Bloomberg

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage